FIVE Most Frequently Asked Questions About HealthPlus!

Have you been hearing about how thousands of Canadian business owners have been saving money by using HealthPlus? Would you like to know how? Here are the 5 most frequently asked questions about HealthPlus!

-

- What medical expenses are eligible?

Eligible expenses can range from eye exams, glasses/contacts, medications, chiropractic visits or dental expense to name a few. For a full list of eligible expenses, please visit www.healthplusplan.ca/the-benefits.

- What medical expenses are eligible?

-

- Are my dependent’s eligible?

Eligible dependents include your legal spouse, unmarried children under the age of 21 or 25 if attending college or university on a full time basis or are financially dependent on you.

- Are my dependent’s eligible?

-

- Why are there taxes on my invoice?

According the provincial legislation, health benefits are considered a taxable item. Each province assigns their own set of taxes. This can include HST, PST and Ontario premium tax. Even with the taxes, the HealthPlus program remains an excellent, tax-effective strategy. By using HealthPlus instead of claiming these expenses on your personal tax return (under the Medical Expense Tax Credit), most clients will save an additional 15% to 35%. Check out our savings calculator at https://healthplusplan.ca/the-benefits/.

- Why are there taxes on my invoice?

-

- How far back can I claim an expense?

According to CRA guidelines, all incurred expenses should be reported in the Corporation’s fiscal year to which they may apply. If audited, failure to do so might result in disallowed claims and or filing amended tax returns and or penalties/interest.

- How far back can I claim an expense?

-

- How I submit a claim?

It’s simple, and adding a receipt takes less than 30 seconds!

- How I submit a claim?

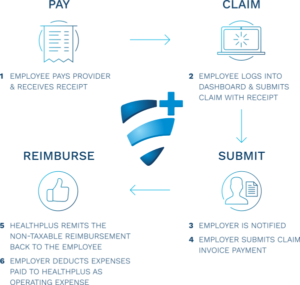

Step 1 – Employee incurs a medical expense and pays the provider personally, obtaining a receipt.

Step 2 – The Employee logs in to their personal dashboard, and adds a new claim, by attaching images of medical expense receipts and submits claim to HealthPlus to ensure receipt eligibility.

Step 3 – Employer is notified that an Employee has submitted a claim. Once verified and approved, the Owner/Employer receives invoice pertaining to the approved claims submitted by the Employee.

Step 4 – Employer submits claim invoice payment via company cheque or through pre-authorized debit.

Step 5 – Once claim invoice payment has been received, HealthPlus remits the non-taxable reimbursement back to the Employee.

Step 6 – The Employer deducts the expenses paid to HealthPlus as an operating expense.

Get your saving Started today! www.healthplusplan.ca

Here to help if you have any questions:info@healthPlusplan.ca

613-226-1964